What is a Step-Up SIP Calculator?

A Step-Up SIP Calculator is a financial tool designed to help investors estimate the potential returns of a Systematic Investment Plan (SIP) where the investment amount increases annually. It considers factors like initial investment, annual increase percentage, expected return rate, and investment duration to project future wealth accumulation.

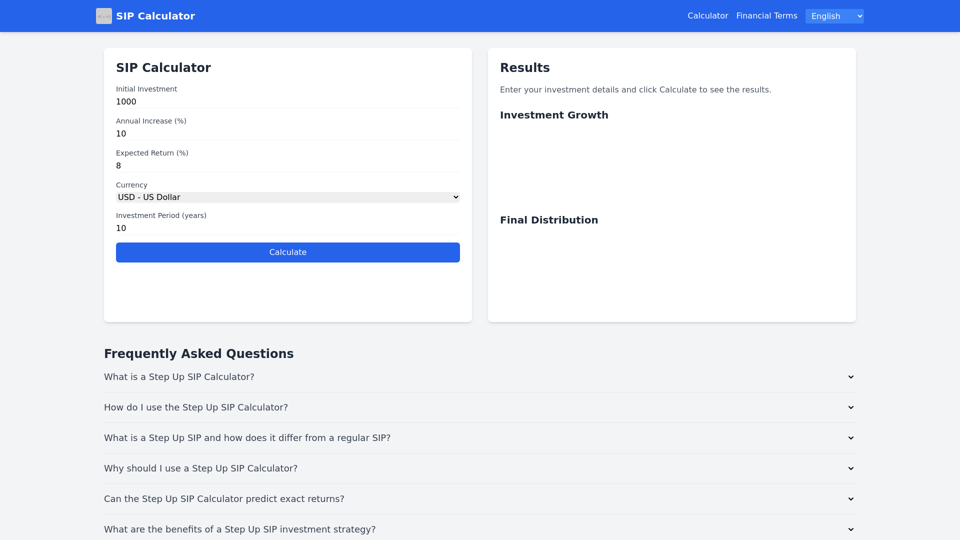

Features of Step-Up SIP Calculator

Our calculator features a unique bar graph visualization of your yearly returns, allowing you to see at a glance how your investment grows each year. This visual representation helps you understand the power of compound interest and increasing contributions over time, enabling more informed investment decisions.

How to Use the Step-Up SIP Calculator

To use our Step-Up SIP Calculator:

- Enter your initial monthly investment amount.

- Specify the annual increase percentage for your investment.

- Input the expected annual return rate.

- Select your preferred investment duration in years.

- Choose your currency.

- Click "Calculate" to see your projected investment growth and final amount.

What is a Step-Up SIP and How Does it Differ from a Regular SIP?

A Step-Up SIP is a variation of a regular Systematic Investment Plan where you increase your investment amount periodically (usually annually). Unlike a regular SIP where the investment amount remains constant, a Step-Up SIP allows you to gradually increase your investments, potentially leading to higher returns over time.

Benefits of Using a Step-Up SIP Calculator

Using a Step-Up SIP Calculator helps you:

- Visualize the potential growth of your investments over time.

- Compare different scenarios by adjusting variables like initial investment and annual increase.

- Make informed decisions about your investment strategy.

- Plan for long-term financial goals more effectively.

Can the Step-Up SIP Calculator Predict Exact Returns?

While our Step-Up SIP Calculator provides a good estimate based on the information you input, it's important to remember that actual returns may vary due to market fluctuations and other factors. The calculator assumes a constant rate of return, which may not reflect real-world market conditions.

Benefits of a Step-Up SIP Investment Strategy

Benefits of a Step-Up SIP include:

- Aligning your investments with potential income growth over time.

- Potentially higher returns compared to a regular SIP due to increased investments.

- Better equipped to combat inflation as your investment amount grows annually.

- Flexibility to adjust your investment increase based on your financial situation.

Risks Associated with Step-Up SIPs

While Step-Up SIPs can be beneficial, they do come with some considerations:

- Increased financial commitment over time, which may become challenging if your income doesn't grow as expected.

- Market volatility can affect returns, especially in the short term.

- Requires discipline to maintain increasing investments over a long period.

How Often Should I Increase My SIP Amount in a Step-Up Plan?

Most Step-Up SIPs increase annually, which is what our calculator is designed for. However, some investors might choose to increase their investments more or less frequently based on their financial situation and goals. Our Step-Up SIP Calculator allows you to see the potential impact of annual increases.

Can I Use the Step-Up SIP Calculator for Other Types of Investments?

While our calculator is specifically designed for Step-Up SIPs, the principles can be applied to other regular investment plans where you increase your contribution over time. However, the results may not be as accurate for other investment types with different structures or tax implications.

How Does Inflation Affect Step-Up SIP Investments?

Step-Up SIPs can be an effective tool to combat inflation because you're increasing your investment amount over time. Our Step-Up SIP Calculator doesn't directly account for inflation, but by setting a higher annual increase percentage, you can simulate keeping pace with or outpacing inflation in your investment strategy.