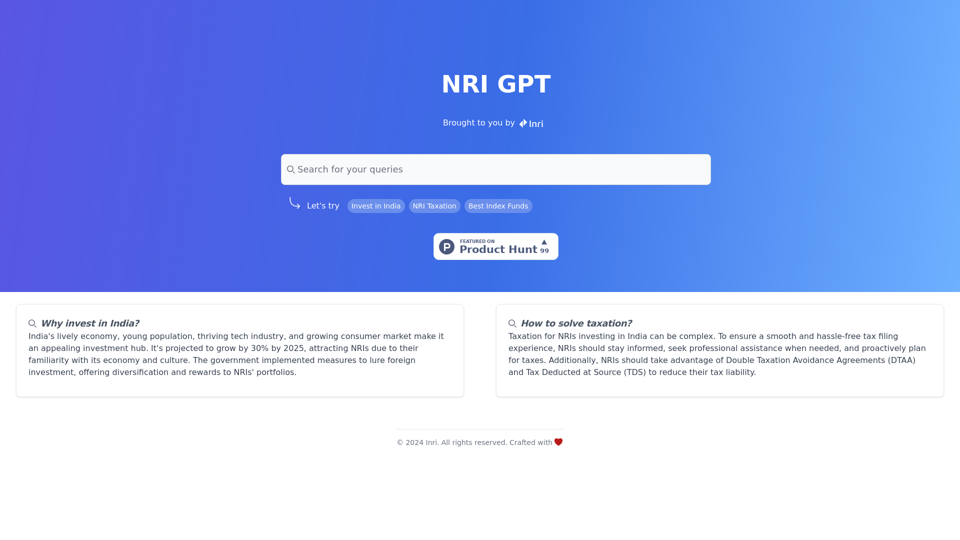

What is NRI GPT?

NRI GPT is a platform designed specifically for Non-Resident Indians (NRIs) to invest in India, providing access to a vast array of investment opportunities, including index funds, and expert guidance on NRI taxation. The platform aims to simplify the investment process for NRIs, leveraging India's growing economy, young population, and thriving tech industry.

Feature

The key features of NRI GPT include:

- Expert guidance on NRI taxation

- Access to a wide range of investment opportunities, including index funds

- Simplified investment process for NRIs

- Proactive tax planning and assistance

- Advantage of Double Taxation Avoidance Agreements (DTAA) and Tax Deducted at Source (TDS)

How to use NRI GPT

To get started with NRI GPT, NRIs can follow these steps:

- Stay informed about the Indian economy and investment opportunities

- Seek professional assistance when needed

- Proactively plan for taxes and take advantage of DTAA and TDS

- Explore the various investment options available on the platform

- Leverage the expertise of NRI GPT to simplify the investment process

Price

The pricing of NRI GPT is competitive and affordable, with options to suit different investment needs and goals. NRIs can choose from a range of plans, including subscription-based models, to access the platform's features and expertise.

Helpful Tips

Here are some helpful tips for NRIs investing in India:

- Stay up-to-date with changes in tax laws and regulations

- Seek professional assistance to ensure compliance with tax laws

- Diversify your investment portfolio to minimize risk

- Take advantage of DTAA and TDS to reduce tax liability

- Proactively plan for taxes to avoid last-minute hassles

Frequently Asked Questions

Why invest in India?

India's growing economy, young population, and thriving tech industry make it an attractive investment hub for NRIs.

How to solve taxation for NRIs?

NRIs can solve taxation issues by staying informed, seeking professional assistance, and proactively planning for taxes.

What are the benefits of using NRI GPT?

NRI GPT provides expert guidance on NRI taxation, access to a wide range of investment opportunities, and a simplified investment process for NRIs.