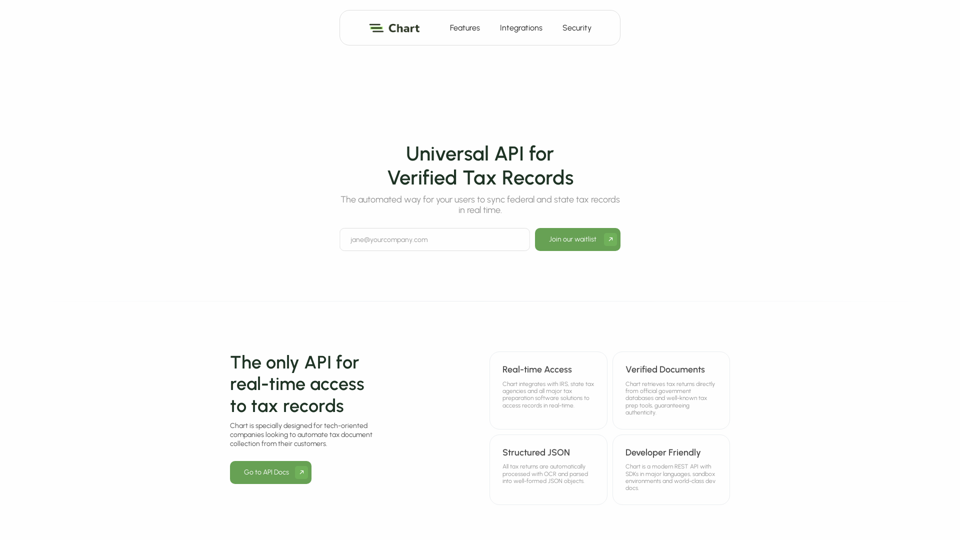

What is Chart?

Chart is an automated API for verified tax records, designed for tech-oriented companies to collect tax documents from their customers in real-time. It integrates with the IRS, state tax agencies, and major tax preparation software solutions to access records in real-time.

Features

- Real-time access to tax records

- Verified documents retrieved directly from official government databases and well-known tax prep tools

- Structured JSON output for easy processing

- Developer-friendly API with SDKs in major languages, sandbox environments, and world-class dev docs

- Multiple submission options for users, including connecting IRS and state online tax accounts, tax prep software, or uploading PDFs

How to use Chart

Chart provides a modern REST API that allows developers to easily integrate tax document collection into their applications. With Chart, users can submit their records through various methods, and the API will automatically process and parse the documents into well-formed JSON objects.

Price

Contact Chart's sales team to learn more about pricing and to get started with effortless tax document collection.

Helpful Tips

- Use Chart to automate tax document collection and reduce manual processing time

- Leverage Chart's real-time access to tax records to improve the user experience

- Take advantage of Chart's developer-friendly API and SDKs to quickly integrate tax document collection into your application

Frequently Asked Questions

- Is Chart secure? Yes, Chart prioritizes security and compliance, with non-persistent credentials, granular access, and PII reduction capabilities.

- Is Chart compliant with major regulations? Yes, Chart supports major compliance frameworks, and reports are available upon request.

- Can I customize the consent flow for my users? Yes, Chart provides a customizable consent flow that allows users to choose which documents to share.